2026: Opportunity Favors the Prepared Dealer

Posted Wednesday, December 31, 2025

Q3 Negative Equity Record Is ‘Wake-Up Call’ for Auto Finance

Posted Wednesday, December 31, 2025

Tricolor CEO received a $6.25 million bonus weeks before company’s bankruptcy

Posted Wednesday, December 31, 2025

- Tricolor CEO Daniel Chu directed a deputy to send him $6.25 million in bonuses in August, weeks before the company filed for bankruptcy, U.S. prosecutors alleged.

- Chu is accused of engaging in “systemic fraud” over roughly seven years, through 2025, according to an indictment unsealed on Wednesday.

- Prosecutors say Chu used some of the bonus money to buy a “multimillion-dollar property” in Beverly Hills, California.

- The abrupt collapse of Tricolor was one of a string of defaults that churned the U.S. banking industry this fall.

The CEO of subprime auto firm Tricolor directed a deputy to send him $6.25 million in bonuses in August as fraudulent schemes propping up the company unraveled, U.S. prosecutors alleged.

Daniel Chu, the CEO and founder of Tricolor, told Chief Financial Officer Jerome Kollar to send the final two payments of his $15 million annual bonus on Aug. 19 and 20, according to a federal indictment unsealed on Wednesday.

Chu, who is accused of engaging in “systemic fraud” over roughly seven years through 2025, used some of the money to buy a “multimillion-dollar property” in Beverly Hills, California, later that month, according to the filing.

Within days of Chu’s bonus payments, Tricolor put more than 1,000 employees on unpaid leaves of absence. By Sept. 10, the company filed for bankruptcy protection.

Lawyers representing Chu didn’t immediately respond to emails requesting comment on the allegations.

Prosecutors say Tricolor created about $800 million in “bogus collateral” — at Chu’s direction — by double-pledging the same assets for multiple loans and by having employees manually alter records to make delinquent loans appear eligible as collateral, according to the indictment.

The abrupt collapse of Tricolor was one of a string of defaults that churned the U.S. banking industry this fall, sparking concerns over underappreciated risks in the American financial system.

Around the time of the bonus payments, Chu allegedly knew his company was, in his own words, “basically history,” according to the filing.

Prosecutors cited “secretly recorded” calls in August that included Chu, his CFO and chief operating officer where the founder cast about for ways to keep the company’s lenders at bay.

While the indictment didn’t name the banks that Tricolor allegedly defrauded, JPMorgan Chase, Barclays and Fifth Third Bank have disclosed charges tied to the borrower.

After Tricolor’s lenders confronted Chu over questions about collateral pledged for loans, the CEO proposed a lie that some of the manipulated data was tied to a Trump administration loan deferment program, according to the indictment.

He then considered another tactic: blaming the banks for ignoring red flags as a way to extract a settlement and keep his company alive, prosecutors said.

In doing so, Chu allegedly compared Tricolor with Enron, the energy company that collapsed in 2001 after the discovery of accounting fraud.

“Enron obviously has a nice ring to it, right?” Chu said, according to the documents. “I mean, Enron, Enron raises the blood pressure of the lender when they see that.”

Source: CNBC

FTC issues warning letters on Consumer Review Rule violations

Posted Wednesday, December 31, 2025

The Federal Trade Commission Monday sent warning letters to 10 companies for potentially violating the Consumer Review Rule.

The Consumer Review Rule, effective October 2024, prohibits the publication of fake or false consumer reviews, providing compensation or incentives for positive or negative reviews, operating a company-controlled review website, suppressing negative reviews, and using fake social media indicators.

The letter sent to the companies, which were not publicly identified, stated the FTC had reason to believe they had violated the Consumer Review Rule and advised them to “immediately cease and desist” the conduct. The FTC press release about the letters said non-formal determinations were based on consumer complaints and information provided by the companies.

“Fake or false consumer reviews are detrimental to consumers’ ability to make accurate and informed choices about the products they are buying – something of particular importance during the holiday season,” said Christopher Mufarrige, Director of the FTC’s Bureau of Consumer Protection, in a press release. “As consumers increasingly depend on online reviews, the FTC is committed to ensuring companies comply with this Rule.”

Violation of the rule can result in federal lawsuits and penalties of up to $53,088 per occurrence.

Source: NIADA

What's New -Dec. 2025

Posted Monday, December 1, 2025

Sales

-

New Feature: Sale Price Default Option

In the upcoming update, you’ll find a new setting under Settings → Defaults → Sales Defaults (line 20) that allows you to set the Sales screen to use the Sale Price instead of the Asking Price as the default value (Sourced from the inventory tab).

If the Sale Price is $0, the system will automatically fall back to the Asking Price, ensuring the pricing field is never left blank.

This enhancement gives your sales team more flexibility while keeping your workflow compliant, accurate, and consistent with your advertised prices.

-

New Feature: Business Customer Option Added to AutoFinance Plus

AutoFinance Plus now includes a Business Customer option—similar to AutoDealer Plus—allowing you to designate and manage business accounts with ease.

A new select box for Business Customer will appear in the Finance Info title banner, located next to the existing Lease option. This enhancement improves workflow flexibility and ensures accurate customer classification for finance agreements.

If you have any questions or need assistance enabling this feature, our TSM team is here to help.

-

California Dealers: GAP Cap Enforcement in ASN Menu

For California dealers using the ASN Menu to sell GAP, state-imposed GAP caps are now enforced directly in the menu, just as in the DMS.

-

The cap is based on the default cash down amount.

-

If a lower cash down is selected, the system could technically allow a higher GAP price, but the menu will still cap GAP at 4% of the base amount financed.

This ensures compliance with California regulations while giving your team flexibility during the sale.

-

Updated Bushing Law Feature in F&I Tab

Based on dealer feedback, we’ve redesigned the Bushing Law feature in the F&I tab—thank you for your input!

Key Enhancements:

-

A new “Ignore” button has been added. All actions—Ignore, Decline, Approve—are fully logged.

-

Each Form 553 print requires one of these responses.

-

Phone carriers are now displayed.

-

Texting to work numbers is blocked, and phone calls do not count as official Decline/Approval.

-

Communication logs are linked directly to each Bushing log.

-

Overall status shows “Complete” once all logs are resolved; otherwise, it shows “Incomplete”.

-

BushingAge has been added to Custom Reports for enhanced tracking.

These updates help streamline your compliance workflow while keeping communications clear and fully documented.

Contract Screen

-

Florida Dealers: New Bill of Sale Form (HSMV 82050)

In AutoFinance Plus, Florida dealers now have a new Bill of Sale form (HSMV 82050) available for repossessions in the Collateral screen.

This update helps ensure compliance with Florida’s documentation requirements for repossessed vehicles.

Reports

-

New Feature: Faster Loading for Custom Reports

ASN has improved how Custom Reports load to significantly boost speed and reduce wait times.

Custom Report data now refreshes automatically every hour, allowing most reports to open much faster throughout the day. This improvement enhances performance without affecting standard ASN CAN reports.

If you make changes and need a report to reflect updates immediately, you can still pull live data:

-

Go to line 6 – Custom Rpt Data

-

Select “Live”

-

The system will refresh instantly (may take a few minutes, similar to the prior method)

This gives you the best of both worlds—faster daily use and on-demand live data when needed.

-

New Trade Source Deskperson Field Added to Custom Reports

A new field, TradeSourceDeskperson, has been added to the Custom Report data sources for All Vehicles and Unsold Vehicles.

This enhancement helps dealers track profit and performance by the desk manager who sourced or took in the trade, giving better visibility into trade-in effectiveness and accountability.

-

New Field: IsBusiness Added to Custom Reports

A new field, IsBusiness, has been added to the Sales List report source in Custom Reports.

This allows dealers to identify and parse sales where the customer is a business, even if the transaction is classified as Retail. It provides better reporting and analysis for business versus individual customer sales.

Settings-Security

-

New Security Feature: Write-Down Control (ID 950)

A new Security ID 950 has been added to control access to the Write-Down button in the Accounting → Journal Entries screen and on line 67 in Inventory.

This allows dealerships to restrict write-down actions to authorized users, enhancing internal controls and protecting financial accuracy.

Bookkeeping

-

New Feature: Flooring Status Alerts

When selecting a flooring company in Write a Check, any invoice with a status of Tripped, Final, or Locked (excluding Pending) will now be highlighted in red.

Hovering over the invoice line will also display the vehicle’s sold date, giving you quick insight before posting payments.

Accounting

-

New Feature: Automatic Memo Note for Reprinted Checks

In Accounting → Check Register, when you reprint a check using a new check number, the memo field will now automatically include:

“Reprint, Original Check #XXXX”

This makes it much easier to search, audit, and track any checks that were reissued.

Tip:

If you still need to issue a check, we recommend reprinting it with a new check number rather than voiding or reversing the original. This keeps your records clean and improves traceability.

Settings-Security

-

New Security Feature: Write-Down Control (ID 950)

A new Security ID 950 has been added to control access to the Write-Down button in the Accounting → Journal Entries screen and on line 67 in Inventory.

This allows dealerships to restrict write-down actions to authorized users, enhancing internal controls and protecting financial accuracy.

CRM

-

New Feature: AI-Powered Follow-Up in CRM

When viewing a client in ASN CRM, click the (+) next to Tasks & Appts and select “Create Follow Up.” You can choose from multiple follow-up types, set a time, and add notes.

New AI Option: Click “Generate With AI” and the system will recommend a follow-up using your notes and text logs, providing suggested verbiage you can still edit.

This feature speeds up customer contact while keeping communications consistent and uniform across your team.

-

New Feature: AI-Powered Task System in CRM

When viewing a client in ASN CRM, click the (+) next to Tasks & Appts and select “Create Follow Up.” You can choose from multiple follow-up types, set a time, and add notes.

New AI Option: Click “Generate With AI” and the system will recommend a follow-up using your notes and text logs, providing suggested verbiage you can still edit.

This feature speeds up customer contact while keeping communications consistent and uniform across your team.

-

Enhanced TAG Display in Digital Recon (ASN CRM)

Digital Recon now displays TAGs in four columns, making it much easier to view and manage long TAG lists at a glance.

In addition, the Details page now respects your TAG priority/order settings, ensuring your most important TAGs appear first and remain consistently organized throughout the workflow.

Latest System Update

-

The Upcoming version is 7.0.18.80 —Our newest update is rolling out in phases. If you don’t see it yet, no action is needed; it will arrive automatically. Once updated, you’ll have access to the latest features and improvements to keep your system running at its best.

Data Breach Allegedly Affects 700Credit, Exposing Millions of Customer Records

Posted Monday, December 1, 2025

Report Claims More Than Eight Million Records Offered for Sale on Dark Web

A recent online report alleges that 700Credit, a provider of credit-related services, has suffered a significant data breach potentially affecting more than eight million customer records. The breach reportedly occurred in late October.

700Credit has not publicly confirmed the breach or provided any statement regarding these allegations; however, at least one class action lawsuit has already been filed in connection with this incident. Furthermore, we have become aware of communications from 700Credit to dealers describing the incident and purportedly taking steps to notify affected consumers.

If you are a dealer who uses 700Credit services, many of the same legal and practical considerations apply here as with the widely-reported CDK breach in 2024. This includes notice requirements, and other steps, such as notifying your insurance carrier and contacting your legal counsel. However, there are important differences as well – those are discussed below.

Details of the Alleged Breach

According to the online report, threat actors have posted the stolen data for sale on dark web marketplaces after negotiations with the company allegedly broke down. The dark web listing allegedly includes a sample of 100 records that appear to contain sensitive consumer identity and verification information. The exposed data fields shown in the sample reportedly include: full names; Social Security numbers; dates of birth; residential addresses; and employment information (in some records).

Guidance for Dealers

If you use 700Credit, the first step is to seek information from 700Credit by contacting your 700Credit representative – and to do so quickly. You need to determine whether any of your customers were affected by the incident. Dealers should specifically ask whether your customer data was exposed and if so: (a) how many of your customer records in total; (b) which specific individuals (those will be the individuals you may need to notify); and (c) the state of residency of each individual (how many from each state, if applicable). You should also obtain details about 700Credit’s plan to notify affected consumers, regulatory agencies, and/or credit reporting agencies, whether the notice will be provided on your behalf (in your name) or not, the timeline for official notifications, and whether 700Credit is planning to address the notice in a timely and adequate manner under all state and federal laws.

Time is of the essence because you want to notify consumers in time for them to stop the potential problems. In most cases, under both state and federal law, the obligation to notify consumers must be met quickly. It varies, but the notice obligations are generally stated as something to the effect of “as soon as possible and no later than 30 days from the incident.”

Second, ensure that the contract amendments required under state privacy law and the FTC Safeguards Rule, with 700Credit (and all other vendors) are signed and up to date. ComplyAuto can help you with that process. We work with all dealer vendors and help you ensure that you have signed agreements with all vendors, including 700Credit if needed. See more details on that below.

Are You Responsible for Notifying Consumers and Regulators?

It is important to note that even if 700Credit is notifying consumers and/or regulators and taking other steps to rectify the situation, that may not satisfy all of your notice or other obligations to your customers under your state (or federal) law.

Remember that the basic “rules” are that dealers are generally responsible for breaches or security events involving their customer data, even when the incident occurs at a dealership service provider. That means that dealers are ultimately potentially responsible for ensuring adequate notice is sent to affected consumers, state AGs, credit reporting agencies, and/or the FTC. See the detailed guidance at the links above for more details.

NOTE: The notice obligations vary under state and federal law. There is no guarantee that any customer notice will be sufficient under your state law or federal law. Therefore, while dealers should certainly confirm that 700Credit will be notifying your affected customers, unfortunately, that may not end the inquiry.

ComplyAuto Data Breach Wizard

As a reminder, ComplyAuto customers have access to a Data Breach Wizard within the ComplyAuto software that will walk you through the complicated questions you need to answer about:

- The scope of the incident – how many of your customers were affected

- Whether you must notify affected customers

- Whether you are required to provide credit monitoring services to affected customers

- Potential state Attorney General notification requirements

- Consumer reporting agency notification obligations

- Potential Federal Trade Commission notification requirements

This tool can help you navigate the complex web of notification requirements and ensure compliance with applicable state and federal laws. It will even provide a sample notice letter if needed.

This Incident Differs in Some Ways From Other Recent Vendor Breaches

While the general considerations and requirements regarding breach notice are similar to those in the 2024 CDK incident, this incident is different from CDK in several ways.

First, even if your customer’s information was among the affected data, at this point, it is not clear what the extent of the customer information involved is, or even if it involves customer information provided to 700Credit by your dealership. With your DMS, the data involved came from your dealership, and you had an idea of the scope of data involved. Here, the customer information provided to 700Credit could have come from your system, but even if an individual is your “customer,” it could have come to 700Credit from a motor vehicle finance company, or other third party vendor, or even from a credit inquiry at another dealer.

Even if you find that your customers are among the affected individuals, it may be unclear whose obligation it ultimately is to provide the required notices. You may need to determine whether you will notify your customers (or state or federal regulators) even if it may be unclear that the data at 700Credit came from your dealership. The potential customer relations issues may outweigh the strict legal analysis.

Second, the exact nature of your relationship (if any) with 700Credit may not be as straightforward as your service provider relationship with your DMS provider. Your dealership may have a direct contractual, service provider relationship with 700Credit – and if so, you must confirm that you have the requisite service provider contract amendments required under both federal and state law. However, you need to understand whether you have access to, or utilize 700Credit’s services through another service provider or third party so that you can ensure that your required data safeguards and risk assessment documentation covers 700Credit – either directly (they are a party) or indirectly through that other service provider or third party.

In other words, even if you don’t have a contract with 700Credit directly, you might use their services (and share data with them) through another service provider relationship (Service Provider “X”). You should take steps to ensure that you have the requisite service provider contract amendments required under both federal and state law with Service Provider X, and that those agreements cover the functions of 700Credit. ComplyAuto can help you understand and update your records if needed.

Third, while DMS companies maintain highly sensitive information, the nature of the information that has allegedly been affected here is so highly sensitive that dealers should work with all due speed in seeking answers. Given the severity of potential harm to consumers from potential exposure of Social Security numbers, dates of birth, and credit information, dealers may wish to notify their customers even if they cannot ascertain with any certainty the nature or scope of the incident among your customers. Again, that is a difficult legal question about which you should consult with legal counsel.

Act with Urgency Given the Deadlines and the Sensitive Nature of the Data

Again, the most important step you can take now is to reach out to 700Credit to obtain details about whether your customers were affected by the alleged incident – and to do so quickly. Remember that the consumer notice you are required to provide includes important information for consumers about how they can:

- Place fraud alerts on their credit reports

- “Freeze” their credit to prevent unauthorized access

- Take advantage of credit monitoring or other services

- Take other protective measures to avoid identity theft or other incidents

Providing this information promptly—even in the absence of complete certainty—can help your customers take protective action and may reduce potential harm. Note, however, that it is not always an easy decision to send notice to consumers who may not have been affected, as sending a notice when not required can also cause consumer concern and distress. Dealers should consult with their legal counsel, insurance carrier, and IT professionals in deciding whether customer notice is appropriate.

One Last Reminder

The steps above are the most urgent at this time, but don’t forget that this may require you to also assess the risks related to this issue and account for it under the FTC Safeguards Rule. That is not the pressing issue for today (and again, ComplyAuto can help), but don’t forget that incidents such as these will require some steps to be taken (and documented) with respect to periodic assessment of service providers, as well as your information security program under the Safeguards Rule.

Summary

While a data breach can happen to any company, communication is critical. Reach out to 700Credit today. Dealers should (a) get details from 700Credit; (b) notify legal counsel and insurance providers; (c) confirm safeguards and risk assessment documents are completed and signed; (d) use the ComplyAuto Breach Reporting Wizard to determine any reporting obligations, and; (e) consider proactively taking the steps necessary to protect your customers and the dealership.

Source: ComplyAuto

Wholesale Used-Vehicle Prices Decline in October

Posted Monday, December 1, 2025

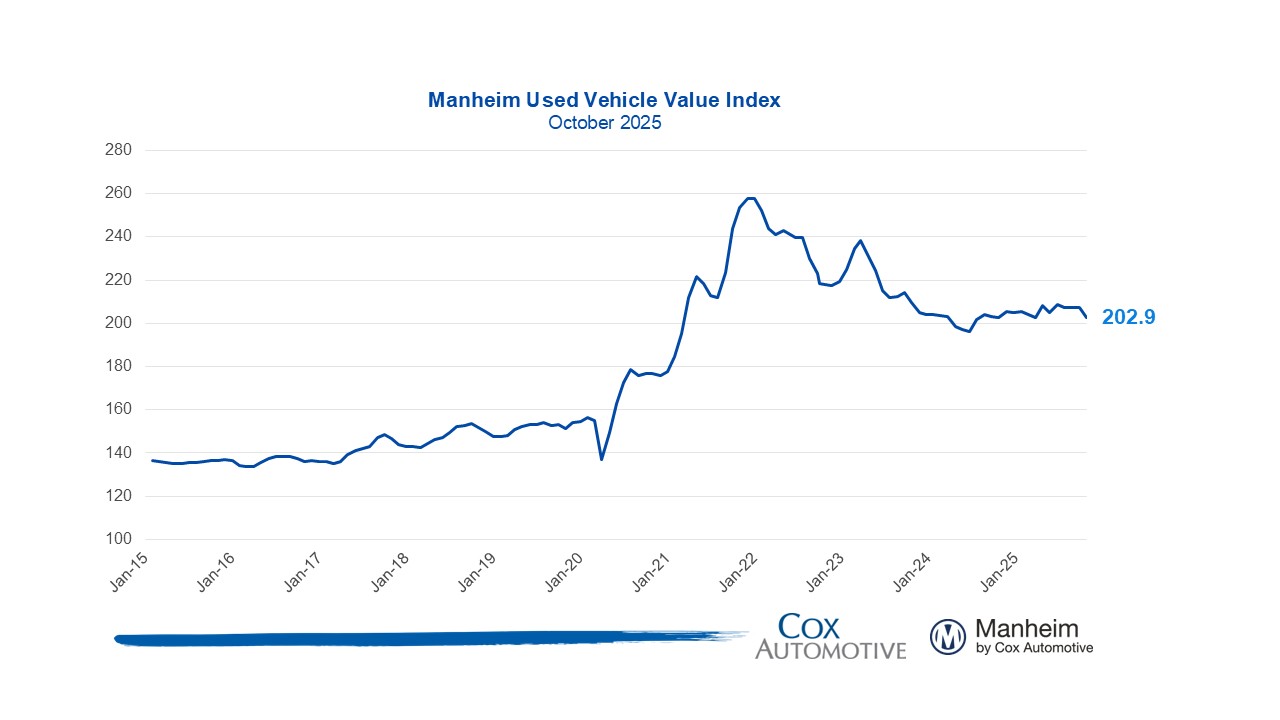

- The Manheim Used Vehicle Value Index (MUVVI) dropped to 202.9, reflecting a 2.0% decline in October’s wholesale used-vehicle prices (adjusted for mix, mileage, and seasonality) compared to September. The index is mostly unchanged compared to October 2024. The long-term average monthly move for October is an increase of 0.3%, as the seasonal adjustment factor is typically the weakest of the year.

- Non-adjusted wholesale vehicle prices fell 3.7% from September and are now 0.2% higher year over year, giving back some of the strength observed throughout most of this year. The long-term average monthly move in non-adjusted values is a decline of 1.5% in October.

Expert Perspective — Jeremy Robb, Deputy Chief Economist, Cox Automotive

“Trends get a little spooky in October for the wholesale markets, typically showing us the highest levels of depreciation in the year – and this year was no exception,” said Jeremy Robb, Deputy Chief Economist at Cox Automotive.

“It’s typical to see higher declines for values in October, as dealers slow down ahead of winter, and the new model year mix grows in retail inventory – both of which can put pressure on values. At the end of October, roughly 49% of all new vehicles on dealers’ lots were MY26s, and that’s higher than we usually see. When coupled with wholesale values that had declined very little so far this year, you can get more volatility.”

“As October progressed, used retail sales were higher each week, and we ended with tighter inventory levels. This led to slower rates of depreciation than normal in the last week of the month. With tighter days’ supply and solid demand, we may see lower depreciation trends for the rest of Q4. Consumers should see higher tax refunds next year and as more dealers catch wind of that, we could expect more demand at wholesale and retail earlier than usual next year.”

MMR Prices, Retention & Sales Conversion

- MMR prices for the Three-Year-Old Index declined 2.3% in October.

- MMR retention averaged 99.0% in October, showing no change from September and down 10 basis points year over year.

- Sales conversion was 54.9% for the period, down more than two percentage points from September but still higher than the most recent three-year average.

Takeaway: MMR prices declined a bit less than the typical 2.5% decline for this period. MMR retention is generally in line with what is expected for this time of year. Meanwhile, sales conversion indicates a modest softening of demand as is normal at this time of year, but conversions remain higher than usual for this time of year.

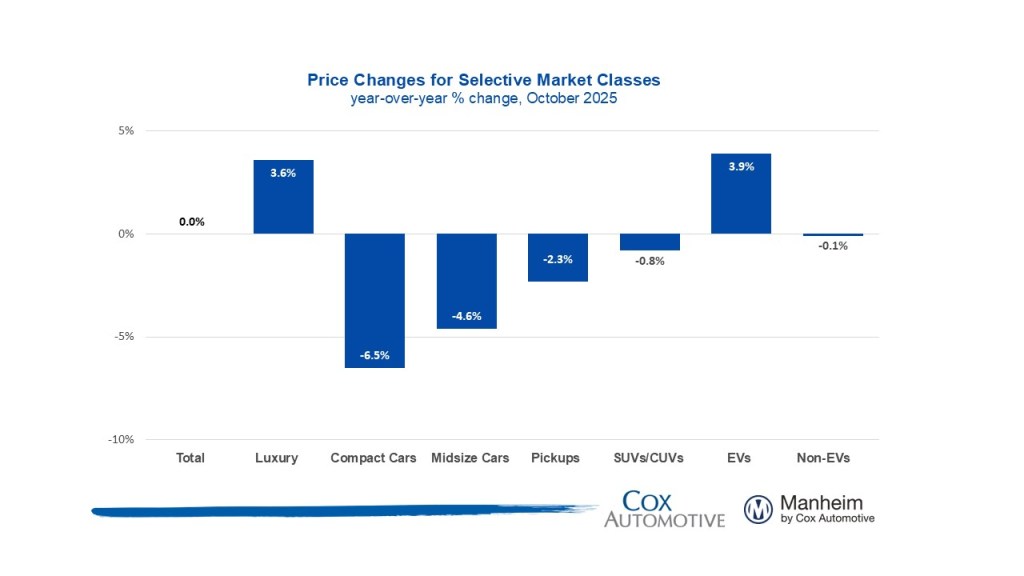

Segment Performance: Year-Over-Year Price Changes

Takeaway: The luxury vehicle segment outperformed the overall market as it has for several months, influenced by higher EV prices helping the segment. On the other hand, compact and mid-size cars continue to see the largest declines compared to last year.

EV versus Non-EV Index

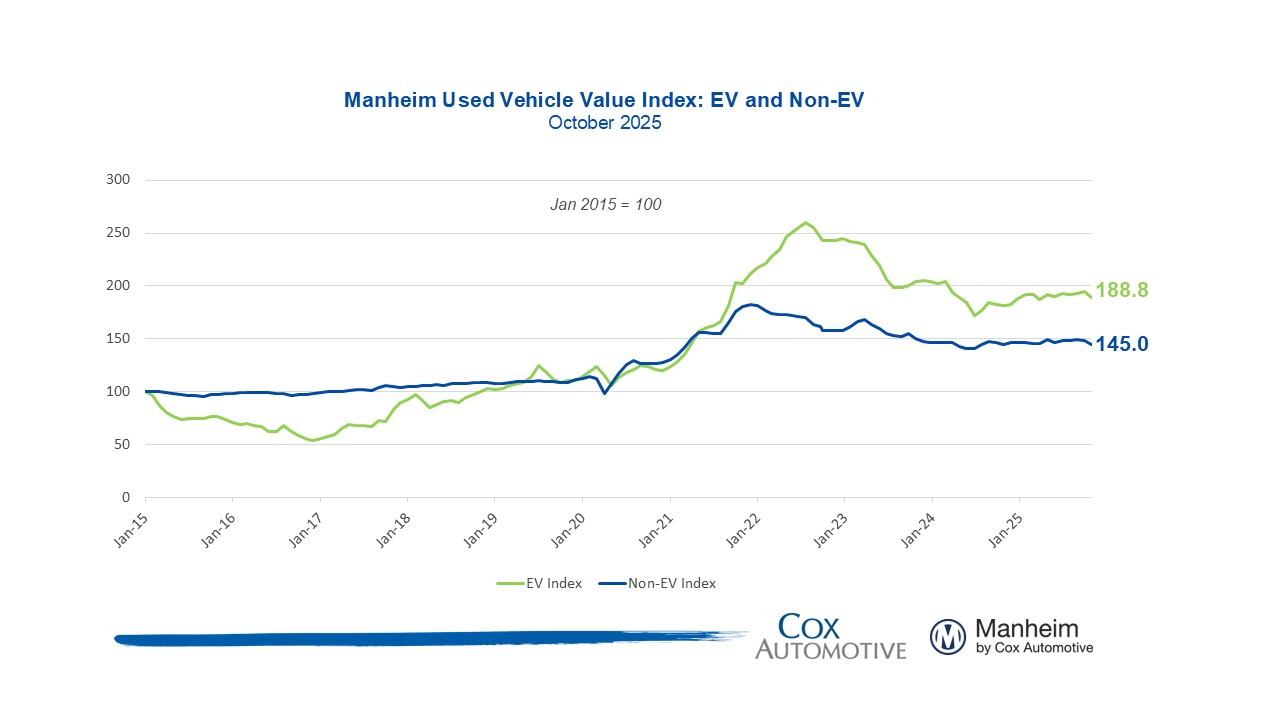

- EVs: The Electric Vehicle (EV) Index was down 3.0% from September (post EV tax credit expiration), but up 3.9% year over year.

- Non-EVs: The Non-EV Index was down 2.2% from September and now down 0.1% year over year.

Takeaway: EV values are more volatile, reflecting changing incentives and consumer interest, but may remain higher as values were more depressed last year compared to the rest of the market.

Wholesale Supply

- At the end of October, wholesale days’ supply rose to 28 days, higher by two days compared to September, but lower by 1 day year over year

Takeaway: Wholesale used vehicle supply usually averages around 30 days, signaling market balance. In October, wholesale supply rose over the month but remained below average, suggesting that inventory may be harder to find, especially as retail demand continues to show strength.

Source: CoxAutomotive

Subprime Auto Loans Blow Up, 60-Day Delinquencies Shoot Past Financial Crisis Peak

Posted Monday, December 1, 2025

Santander Consumer USA is on the forefront of souring subprime-auto-loan backed securities.

Santander Consumer USA, one of the largest subprime auto lenders and the largest securitizer of subprime auto loans, is not alone. But it’s on the forefront. It had $26.3 billion of subprime auto loans as of June 30 that it either owned and carried on its books or that it had packaged into subprime-auto-loan backed securities and sold to investors; in terms of the loans that it collects payments on, 14.5% of the borrowers were delinquent, according to S&P Global Ratings, cited by Bloomberg.

In the industry overall, subprime auto loans that have been packaged into asset-backed securities (ABS) are experiencing the highest delinquency rates in two decades, according to Fitch, which rates these securities. The 60-day delinquency rate surged to 5.93% in August, substantially higher than during the peak of the Financial Crisis at 5.04% in January 2009 (orange line, chart via Fitch):

But “prime” auto loans are holding up very well (blue line in the chart above): Their 60-day delinquency rate is hovering around a historically low 0.28%.

Santander’s loans include a surprising number that defaulted within the first few months, according to Moody’s Investors Service. These early-payment defaults (EPDs) are a hallmark of loosey-goosey underwriting standards that accomplish three things:

- Initially, they boost revenues from fees and high interest rates, and thus paper profits.

- They get weaker borrowers into loans with punitively high interest rates and payments so high that many borrowers will have to default.

- They enable or even encourage fraudulent loan applications.

Concerning the link between fraud and early-payment defaults, Frank McKenna, chief fraud strategist at PointPredictive, told Bloomberg: “We found that depending on the company, between 30% to 70% of auto loans that default in the first six months have some misrepresentation in the original loan file or application.”

OK. But Santander is not trying very hard to prevent fraud. In September, Moody’s pointed out that Santander had verified income on less than 3% of the subprime loans it packaged into over $1 billion of ABS that it was marketing to investors at the time. Income verification is not the only measure, but it’s an important measure of good underwriting practices. In these structured securities, where the highest-rated tranches carried a credit rating of Aaa, the lowest-rated tranches take the first losses, and the top-rated tranches could come out unscathed.

Moody’s said that it expected losses of 24% on this deal, far higher than 17% in losses that Moody’s expected on all of Santander’s ABS.

By comparison, Moody’s cited GM Financial, which also packages subprime auto loans into ABS: In a subprime-loan deal issued in June, it had verified income on 68% of the loans; and Moody’s expected losses of about 10%.

Even though Santander has sold these subprime-auto-loan-backed securities to investors, it is not entirely off the hook, especially when borrowers fail to make the first few payments – the infamous EPDs. It is then obligated to buy back those loans and eat the potential losses itself. According to a Bloomberg analysis, Santander was obligated to buy back 3% of the loans, which according to Moody’s, is a higher rate than Santander’s faced in its earlier securitizations.

But in a deal that it sold to investors last year, Santander has been obligated so far to buy back 6.7% of the loans mostly due to due EPDs, according to a Bloomberg analysis.

So these losses due to early-payment defaults were shifted from ABS holders back to Santander. Moody’s analyst Matt Scully put it this way: “The situation is somewhat perverse in that bondholders are actually benefiting from high early-payment defaults through the repurchases.”

Subprime-auto-loan-backed securities have other protections for bondholders, such as loss-absorbing buffers in form of additional auto loans beyond the face value of the securities.

Nevertheless, the remaining losses are being eaten by the lower-rated tranches of the ABS. And the losses are piling up. According to Fitch, the subprime auto-loan Annualized Loss Ratio rose to 9.4% in August, up from 8.3% in August last year. During the peak of the Financial Crisis in February 2009, the ANL had spiked to 13.1%:

In terms of the overall auto-lending industry and the banking system, how much of a problem are we talking about?

Total auto loans and leases outstanding have soared to $1.3 trillion at the end of the second quarter. Typically, between 20% and 25% of the new loans and leases being originated each quarter are subprime rated. In the first half of this year, about 21% were subprime.

At the end of the second quarter, according to Federal Reserve data, 4.6% of those $1.3 trillion in auto loans and leases – subprime and prime combined – were 90+ days delinquent. This is where delinquencies were in Q3 2009 but below the Financial Crisis peak of 5.3%. In dollar terms, the 90+ delinquencies – most of them by subprime rated customers – amounted to $60 billion:

While delinquencies have skyrocketed, losses are just a small fraction of what subprime mortgages had generated during the Financial Crisis. Subprime auto loans, being about one-tenth the magnitude of subprime mortgages, are not going to take down the big banks. But smaller specialized non-bank lenders could collapse, and some of them have already collapsed.

Given the risks and losses, why is the industry engaging in subprime lending? And why are investors lapping up the subprime-auto-loan backed securities? Follow the money.

Subprime loans are immensely profitable. The dealer gets to sell a car and make a fatter profit on the car itself and on arranging the loan because subprime borrowers know they’re having trouble getting loans, and there is often no negotiation on price, interest rates, or payments. Subprime customers are sitting ducks.

Subprime loans are also high-risk, and lenders want to earn higher rates of return – and charge higher interest rates – to be compensated for the risk. So, until the loans sour, lenders make more money on subprime loans.

At first, everyone is happy. The dealer made lots of money. The lender made lots of money. Investors earn a higher yield on their ABS. And the customer, who is paying out of the nose for all this, is driving a nice car.

But a customer that is struggling and already has some credit problems – which is why the credit score is below “prime” – may have trouble making the payments on a car loan with a 21% interest rate financing not only the car but also the fat profits of the dealer.

It’s quick these days to repo a car and sell it at a wholesale auction. The used-vehicle market is liquid, and transactions are fast, unlike the housing market. So a lender will take some loss on a defaulted car loan, perhaps 30% or 40% of loan value. But given the profits made on the loan before it defaulted and on the loans that do not default, subprime lending, when greed isn’t allowed to run wild, remains a profitable business overall. And it allows customers with subprime credit to buy a car despite the risks for lenders.

Source: Wolfstreet

Protective Adds Portfolio to Acquisition List

Posted Monday, December 1, 2025

BIRMINGHAM, Ala., October 30, 2025--(BUSINESS WIRE)--Protective Life Corporation (Protective), a U.S. subsidiary of Dai-ichi Life Holdings, Inc. (TSE:8750), announced today that it has entered into an agreement to acquire Portfolio Holding, Inc. (Portfolio) and its subsidiaries from Abry Partners. Portfolio is a leading provider of reinsurance management services and finance and insurance (F&I) products for dealers nationwide.This acquisition marks a significant milestone in Protective’s strategic growth within its F&I products and services. By integrating Portfolio’s dealer wealth programs and technology platform, Protective expands its ability to deliver leading solutions that drive dealer success and customer satisfaction.

"Portfolio is a natural fit for Protective—not only for its complementary offerings, but for its shared commitment to innovation and dealer success," said Scott Karchunas, President of Protective’s Asset Protection Division. "Their approach aligns seamlessly with our mission to deliver smarter, more specialized solutions that help dealers grow and thrive. Together, we’re expanding what’s possible in F&I and reinforcing our commitment to long-term value for our partners and their customers."

Founded in 1990 and headquartered in Lake Forest, California, with offices in Dallas and Cleveland, Portfolio offers dealer participation programs that help dealers build long-term wealth through reinsurance structures, enabling them to retain underwriting profits and investment income. With approximately 450 employees and a national, multi-channel distribution network, Portfolio serves millions of in-force customers through vehicle service contracts, GAP coverage and a broad range of ancillary products. Portfolio is an 18-time recipient of the Dealers’ Choice Awards, reflecting its sustained excellence in service and dealer support.

"Joining with Protective opens an exciting new chapter for our team as we seek to scale our impact across the dealer community," said Jeremy Lux, CEO of Portfolio. "Abry Partners has been an outstanding partner in accelerating our growth and innovation capabilities and played a critical role in positioning us for long-term success. Now, through Protective's established network and market expertise, we have a powerful platform to enable us to deliver our proven solutions to a broader dealer base."

Protective Asset Protection has provided F&I solutions to the automotive industry since 1962. Today, it supports over 10,000 dealerships across multiple sectors with a comprehensive suite of vehicle protection plans, dealer participation programs, training, and technology. As of early 2025, the division had more than 10.9 million in-force vehicle protection plans and had paid $7.2 billion in claims.

Over the past decade, Protective Asset Protection has expanded its capabilities through strategic acquisitions including AUL, Revolos and U.S. Warranty. Each has contributed to the division’s evolution as a key part of Protective’s broader business.

"Protective’s Asset Protection Division has become an increasingly important part of our business, and this acquisition marks another milestone in its evolution," said Rich Bielen, President and CEO of Protective. "Portfolio brings a strong track record in dealer wealth programs and a deep understanding of what it takes to help dealers succeed. While life insurance and annuities remain the foundation of our company, expanding our Asset Protection Division enhances our ability to protect more customers and deliver enduring value."

The transaction is expected to close by the end of the year, subject to regulatory approvals and customary closing conditions. Until then, both companies will continue to operate independently.

Upon closing, this transaction will mark Protective’s 61st acquisition and its eighth since becoming part of Tokyo-based Dai-ichi Life Holdings in 2015. Dai-ichi is a global financial services organization with over $433 billion in total assets as of December 31, 2024, serving customers in 10 countries. Protective serves as Dai-ichi’s North American growth platform, pursuing both organic and acquisition-driven expansion.

Maynard Nexsen PC is serving as legal counsel to Protective and TD Securities is serving as its financial advisor. Kirkland & Ellis LLP is acting as legal counsel to Portfolio and Jefferies LLC acts as its financial advisor.

About Protective Asset Protection

Protective Asset Protection has been providing Finance & Insurance solutions for the automotive industry for more than 60 years. We proudly serve thousands of dealerships and financial institutions throughout the U.S. and Puerto Rico with innovative F&I products, training, dealer participation programs and technology. Our portfolio of vehicle protection plans, GAP (Guaranteed Asset Protection) coverage, limited warranties and ancillary products provide opportunities to generate revenue with products that help drive customer retention and satisfaction. Protective Asset Protection is part of the financial services holding company, Protective Life Corporation. For more information about Protective Asset Protection, call 800-794-5491 or visit protectiveassetprotection.com.

Protective Life Corporation has helped people achieve protection and security in their lives for 118 years. Through its subsidiaries, Protective offers life insurance, annuity, asset protection and employee benefit solutions and is helping nearly 17 million people protect what matters most. Protective's more than 3,500 employees put people first and deliver on the company's promises to customers, partners, colleagues and communities—because we're all protectors. With a long-term focus, financial stability and commitment to doing the right thing, Protective Life Corporation, a subsidiary of Dai-ichi Life Holdings, Inc., has $125 billion in assets, as of Dec. 31, 2024. Protective is headquartered in Birmingham, Alabama, and is supported by a robust virtual workforce and core sites in the greater Cincinnati area and St. Louis. For more information about Protective, visit protective.com.

About Portfolio

Founded in 1990, Portfolio’s primary business is turnkey reinsurance management of vehicle service contracts, warranties and other F&I products sold in the automotive dealership. Its top executives have specialized in reinsurance since the origination of the concept over 30 years ago. Portfolio is marketed to dealers through a nationwide network of professional independent agents and reinsurance specialists. The company also administers reinsured and non-reinsured warranty programs for other markets. Portfolio is headquartered in Lake Forest, CA, with offices in Dallas, TX, and Cleveland, OH. More can be learned about Portfolio at www.PortfolioReinsurance.com.

About Abry Partners

Abry Partners is one of the most experienced and successful sector-focused private equity investment firms in North America. Since its founding in 1989, the firm has completed over $90 billion of leveraged transactions and other private equity or preferred equity placements. Currently, the firm manages $17 billion of assets across several fund strategies. More information about Abry Partners: www.abry.com.

Source: Businesswire

DOJ casts doubt on CFPB funding

Posted Monday, December 1, 2025

The U.S. Department of Justice (DOJ) has ruled that the Consumer Financial Protection Bureau’s (CFPB) current funding mechanism is unlawful, casting doubt on the agency’s future.

On Tuesday, the CFPB notified the court overseeing NTEU v. Vought that the DOJ’s Office of Legal Counsel (OLC) concluded the Bureau cannot legally request funds from the Federal Reserve at this time. The OLC determined that the Federal Reserve currently has no “combined earnings” from which the CFPB can draw funds, as required under the Dodd-Frank Act. Because OLC opinions are binding on Executive Branch agencies, the CFPB must comply.

While the Bureau could seek an appropriation from Congress to continue operations, such a funding request appears unlikely amid recent efforts by the Trump administration to administratively wind down the agency’s activities.

The U.S. Supreme Court in May 2024 ruled the funding for the CFPB was constitutionally valid. After hearing a challenge from the U.S. Fifth Circuit Court of Appeals to the funding of the agency, the court handed down a 7-2 decision to affirm its constitutionality.

In the majority opinion of the court, Justice Clearance Thomas wrote the “funding mechanism” complied with the Appropriations Clause.

“The statute that authorizes the Bureau to draw money from the combined earnings of the Federal Reserve System to carry out its duties satisfies the Appropriations Clause. Accordingly, we reverse the judgment of the Court of Appeals and remand the case for further proceedings consistent with this opinion,” Thomas wrote.

The Dodd-Frank Act Wall Street Reform and Consumer Protection Act passed by Congress in 2010 created the CFPB. It was in reaction to the 2008 financial crisis.

“Congress charged the Bureau with enforcing consumer financial protection laws to ensure ‘that all consumers have access to markets for consumer financial products and services and that markets for consumer financial products and services are fair, transparent, and competitive,’” Thomas wrote.

The CFPB officially rescinded its Non-Bank Registration Rule (NBR Rule), which had tracked non-bank lenders accused of violating consumer financial protection laws. Finalized in July 2024 and implemented that September, the rule was introduced under the Biden administration to enhance the Bureau’s market monitoring and nonbank supervision functions by collecting and publishing information about enforcement orders and compliance efforts. In announcing the repeal, the CFPB cited the rule’s high costs and limited benefits, noting significant overlap with existing state-level frameworks. The decision marks the latest in a series of deregulatory measures undertaken since the start of the Trump administration. The CFPB initially proposed rescinding the rule back in May.

Source: NIADA

What's New -Nov. 2025

Posted Friday, October 31, 2025

Sales

-

New Security Feature: #948 – Un-Lock Sale

A new security option (#948 – Un-Lock Sale) has been added to give tighter control over sales transactions.

When restricted, sales team members cannot unlock a sale, even if they have Security #93 – Lock Sales. This ensures stricter adherence to approved sales processes and reduces the risk of unauthorized changes.

Contract Screen

-

Colorado Dealers: New DR 2842 Form

A new Colorado DR 2842 – Supplemental Secure and Verifiable Identification form is now available.

Dealers can add this form to sales documents, helping ensure compliance with Colorado’s updated identification requirements.

-

New Feature: Spanish Arbitration Addendum Signature

A new eSign feature has been added to the Spanish version of the Arbitration Addendum, allowing customers to electronically sign the document for faster, paperless processing.

-

Washington Dealers: New LAW Form 553

Effective November 1, 2025, Washington dealers will have a new LAW® form 553 available: Washington Retail Installment Sale E-Contract Including Arbitration.

This updated form includes new disclosures and is designed to ensure compliance with Washington’s updated regulations for retail installment sales.

Reports

- New Feature: Custom Reports Auto-Refresh

Custom Reports data now auto-refreshes every hour. This caching speeds up report loading, especially for large datasets or during high server demand, and helps reduce delays caused by busy networks or slow queries.

If you think the data has changed since the last refresh, just go to the 'Custom Report' tab and right-click above line 10 where it says "Custom Report data refreshes every hour" to see the latest refresh time or manually refresh it (which can take up to 5 minutes).

We’re working on more improvements to make reporting faster and more reliable in the coming months.

-

New Feature: Automated Report Emailer Time Control

The Automated Report Emailer now allows you to set the exact time of day to send out scheduled reports (see line 5).

This enhancement gives you greater flexibility to deliver reports at the most convenient or business-critical hours.

-

New Feature: Include Former Sales Team in CRM Reports

In the Reports – CRM tab, you can now check the box on line 5 (BDR label) to include former sales team members who are no longer active in the system.

This enhancement provides a more complete historical view of sales activity and lead performance for reporting and analysis.

-

New Report: RO Declines

A new “RO Declines” report is now available to track any shop ROs with declined items.

To add it to your report list:

-

Right-click on a report button.

-

Navigate to the Shop category.

-

Find RO Declines and check the box to assign it to your list.

This makes it easier to monitor declined repairs and manage shop workflow efficiently.

Bookkeeping

-

New Feature: Inactivate Collection Category Items

You can now inactivate collection category items that you no longer wish to use, even if they were associated with inactive loans.

To use this feature:

-

Go to the Financed Loan or Collections tabs.

-

Open the Collection Category tab.

-

Click the new “Inactivate” button to disable the item.

You can also reactivate inactive items anytime if needed, giving you more flexibility in managing collection categories.

-

New Feature: 2025 IRS Form 1099-C for Charge-Offs

A new report and letter have been added under Finance Loan History in Bookkeeping to help prepare Form 1099-C filings for the 2025 tax year.

The IRS now requires auto dealers to file Form 1099-C for any canceled debt of $600 or more if the dealer is considered an “applicable financial entity.” This includes dealers offering in-house financing or operating through a Related Finance Company (RFC).

This new report makes it easier to track charge-off balances and generate the data needed for IRS compliance.

-

New Security Feature: Second Name on Write-Checks Tab

A new security option (#949) is now available to control the “2nd Name on Check” field.

When restricted, this prevents a software user from adding a second name in the Write a Check screen (line 8 – 2nd Name on Check field), helping maintain tighter control over check issuance.

Accounting

-

New Option: Edit SideNote Description

You can now edit the SideNote description entered on line 38 of a new loan. Simply locate the invoice in the ledger, click the new blue arrow on line 3 – Description, and update the text. The revised info will replace the original entry for clearer recordkeeping.

Latest System Update

-

The Upcoming version is 7.0.18.75 —Our newest update is rolling out in phases. If you don’t see it yet, no action is needed; it will arrive automatically. Once updated, you’ll have access to the latest features and improvements to keep your system running at its best.

Used car prices are revving up

Posted Friday, October 31, 2025

There's sticker shock, and then there's whatever is happening with America's used-car market. Prices for a slightly-less-than-new-car have been soaring over the past few years. Before the pandemic, the average price for a 3-year-old vehicle topped out at a little over $22,000. In 2025, the cost is upward of $31,000. And according to Edmunds, which tracks the car market, that number may soon sound like a bargain.

"I mean, it's kind of mind-boggling for anybody who had the pleasure or context of having bought pre-2020, right?" says Ivan Drury, the director of insights at Edmunds.

You may remember the used-car apocalypse nestled inside the whole-world apocalypse during the COVID-19 outbreak. Supply chain disruptions in new vehicle production, increased competition from rental car companies, and a surge in demand from consumers seeking to socially distance themselves from others behind the wheel caused a scramble for older vehicles. Like many things post-pandemic, the used car sector is not back to normal. The average price of all used car transactions is below its pandemic peak, but still thousands of dollars more expensive than it was six years ago. Prices are creeping up again, too: The most recent Bureau of Labor Statistics data shows they're up 6% over the past year.

"Those hangover effects from so much disruption from years ago, it's all playing out now," Drury says.

With tariffs in the mix and new car prices continuing to creep up, the future may be worse. The answer to the perennial question of when is the "best time" to buy a used car may now permanently be "there's no such thing as a best time." And when it comes time to get a car, new or used, hope you have some time to shop around.

Or as Drury puts it: "It's not just reestablishing your expectations, but coming to terms with today's new reality, which is unfortunately not in your favor."

To state the obvious, before a car can be used, it has to be new. So when there's a slump in new cars rolling off the lot, that hits the used vehicle market down the road. According to data from Edmunds, millions fewer new cars have been sold in the US in recent years. Sixteen to 17 million new cars were sold annually in the US from 2014 to 2019. From 2020 to 2022, that number fell to 13 to 14 million each year. Sales have been creeping back up — Edmunds estimates sales will finally surpass 16 million again this year — but even with the rebound, the ripple effects of the pandemic-era semiconductor shortage and other supply-chain and sales headaches continue to have an impact.

"Those vehicles never entered the vehicle ecosystem to become used vehicles for consumers, and that's the crux of the matter right now, it's that hole that was made," says Jeremy Robb, senior director of economic and industry insights at Cox Automotive.

There simply aren't as many people going to dealerships looking to trade in cars they bought new two, three, or four years ago. And if they are turning up, it's with vehicles that were more expensive in the first place because of pandemic-era pressures. Stephanie Brinley, an automotive analyst at S&P Global, says that because of supply chain issues, carmakers focused on "their most popular models and their most popular trim levels," which tended to be on the middle or high-end of their price range.

"So you have a combination of a vehicle that was more expensive in the first place and relatively low supply," Brinley says.

Leasing is a factor, too. Typically, about 30% new cars are leased every year, Robb explains, but that fell to about 17% in 2022. Automakers would rather customers simply buy a car outright — they make more off of it — so heightened consumer competition for a limited number of pricey new vehicles reduced the need for manufacturers to offer leasing terms, because they were selling premium cars for close to full price. Most leases mature in 36 months, at which point the car is often turned in and put on the used car market.

"The lease maturities have really been contracting over the past year and a half and will continue to contract," Robb says.

Apart from the pandemic, there are other generally consumer-unfriendly shifts in the new car market that are trickling down to the used car market. New cars have gotten extremely expensive as people load up their vehicles with all sorts of pricey features and tech. Once a new car's price goes up, used cars of the same model go up, too, as they tend to be anchored together. American drivers lean toward bigger, pricier cars, which is fine with automakers since the larger models tend to produce more profits. Many more affordable, smaller vehicles have been pulled off the market altogether — RIP to the Ford Focus, Chevy Cruz, and Dodge Dart. The impact is multi-fold: Used cars are more expensive because they were more expensive when they were new, owners may be holding onto them longer to justify the higher price tag, and some more cost-conscious would-be new car buyers are being priced out of the market.

"We're not seeing a great expansion of new vehicles and definitely not entry-level new vehicles, so the people who would look to a $30,000 entry-level model are forced into the used car market," says Sam Fiorani, an industry analyst at AutoForecast Solutions. Some manufacturers are starting to notice the missing part of their lineups and fill it, but even those prices are going up quickly. "Where entry-level was $15,000 not too long ago, it's suddenly closing in on $30,000," Fiorani says.

"Every time you do something that raises the cost of a new car, they're at such high levels already, what you're really doing is creating another used vehicle consumer," Robb says.

When I ask analysts and auto experts whether the used-car price picture is going to get brighter anytime soon, the answer is more or less… not really. While vehicles are taking longer to sell as people hunt for deals and think it through, demand isn't coming down. Nathan Garnett, chief business officer at online marketplace OfferUp, tells me that even as listing prices for used cars have increased on the platform over the past year, sell-through rates have not budged. "Buyers are willing to pay those prices," he says.

It makes sense: The US is very car-dependent, and if you need a car to get to work or school or the grocery store, you need a car, full stop. Plus, driving can be a fun and pleasant way to get around.

As with many other industries, the tariffs are an elephant in the room. Brinley, from S&P Global, says their implications are the "thousand-dollar question." Many automakers have been eating the costs of tariffs, though that can't go on forever if trade uncertainty persists. Brinley says they're "cautiously watching" for trade agreements with the EU and Japan to be solidified, but bigger questions loom around negotiations between the US, Canada, and Mexico — especially since the free trade deal between the three countries is up for review in July 2026. "In the meantime of all of that, automakers are moving through a lot, so prices will come up," she says.

While tariffs haven't been a big factor so far, the anticipation of them caused some people to pull forward their purchase of a new car to avoid anticipated price hikes in the future. That's good for the used market in that they traded in their old car, but at the same time, dealers who are also expecting higher prices paid more for trade-ins than they would have otherwise. "That's messed with the market a bit," Drury says.

Tariff-driven purchases haven't been linear, either, says Kevin Roberts, director of economic and market intelligence at CarGurus, a car research and sales website. They saw sales of new and used vehicles pick up in March and April, around President Donald Trump's Liberation Day tariff announcements, normalize, and then pick back up again toward the end of the summer. "I think people were just kind of like, 'Oh, prices could go up even further. I should go get a car now if I was kind of looking for one," he says.

One of the more uncomfortable realities of the American economy in the wake of the pandemic is that prices will not return to their previous levels. While inflation has slowed, we won't see widespread deflation (nor do we want to). That means resetting expectations before you walk onto the car lot, developing a bit of price tag amnesia, and kissing that 2013 cost you may have in your head goodbye. There are surely deals to be had, but they're hard to find, and the $20,000 that might have gotten you a solid 3-year-old vehicle 10 years ago will now land you an 8-year-old car with 80,000 miles on it. On used vehicles, we've made our bed, and now we have to lie in it.

"You can't make new used cars," Fiorani says.

Source: BusinessInsider

IRS eases auto loan interest reporting for lenders under new tax law

Posted Friday, October 31, 2025

The IRS guidance lets lenders inform borrowers without adding immediate reporting burdens.

- Lenders do not need to report 2025 auto loan interest directly to the IRS if borrowers receive a statement by Jan. 31, 2026.

- The deduction allows consumers to claim up to $10,000 annually on U.S.-assembled vehicle loans, retroactive to 2025.

- Transitional relief protects lenders from penalties and reduces administrative burden while IRS systems are updated for 2026 reporting.

The IRS on October 21 issued transitional relief for lenders required to report auto loan interest under the One Big Beautiful Bill Act (OBBBA), easing compliance for 2025. The move eliminates the obligation for lenders to file information directly with the IRS, provided borrowers receive a statement showing total 2025 interest by January 31, 2026.

The legislation allows consumers to deduct up to $10,000 in interest annually on new vehicles with final assembly in the U.S., applicable from 2025 through 2028. Income limits apply, and the deduction is available whether taxpayers itemize or take the standard deduction. The transitional relief was introduced to accommodate both lenders and the IRS, which noted that additional time is needed to update forms and systems.

For 2025, lenders can provide interest statements via online portals, monthly statements, annual statements, or other accessible means. Meeting this requirement protects lenders from penalties for failing to report to the IRS or provide timely statements to borrowers. The IRS released a draft Form 1098-VLI for 2026 reporting, but no direct IRS filing is required for 2025.

The auto loan interest deduction reflects a significant benefit for vehicle buyers. Experian data reveals the average new-vehicle loan in the second quarter was $41,983 at 6.8% interest, equating to roughly $2,660 in first-year interest payments. Without this transitional relief, lenders would have been required to collect detailed borrower and loan information, including name, address, interest paid, principal, and vehicle identification, and submit it to the IRS.

President Donald Trump signed H.R. 1 into law on July 4, making the deduction retroactive for 2025. The legislation represents a key element of the administration’s effort to encourage U.S.-assembled vehicle purchases, while minimizing administrative hurdles for financial institutions during the first year of implementation.

The IRS’s transitional guidance provides clarity to lenders and ensures borrowers are informed of the deduction without imposing immediate reporting burdens, enabling a smoother rollout of the new tax benefit.

ASN Tip: This update may also apply to dealers with in-house financing or Related Finance Companies (RFCs). Stay informed and consult your tax professional to ensure proper reporting under the revised guidelines.

Source: CBTNews

CARS Act, Transforming Auto Sales in California

Posted Friday, October 31, 2025

Governor Newsom signed the California Combating Auto Retail Scams (CARS) Act, which will take effect on October 1, 2026. The law aims to increase transparency and consumer protection by requiring dealers to disclose the total vehicle price upfront, banning "valueless" add-ons, and creating a three-day, no-questions-asked return window for used cars under $50,000 with certain mileage and damage restrictions. It also mandates that dealers retain sales records for two years to prove compliance.

Key provisions of the CARS Act

- Transparent pricing: Dealers must clearly state the "total price," including all fees and accessories, in all advertisements and quotes.

- Banned add-ons: Dealers can no longer charge for add-ons that provide no benefit to the buyer, and they must disclose that optional products like GAP insurance or service contracts are optional.

- Three-day return policy: For used vehicles priced under $50,000, buyers have three days to return the car for any reason, as long as they haven't driven it more than 400 miles and it's in the same condition.

- Return fees: Dealers can charge a restocking fee of up to 1.5% of the sale price (with a minimum of $200 and a maximum of $600) and a per-mile fee for each mile over 250, up to a maximum of $150.

- Record retention: Dealerships must keep records of their compliance for two years.

- Add-on payment: Buyers have 10 days to pay for any optional add-ons, instead of the previous requirement of paying at the time of purchase.

Impact on consumers and dealers

- For consumers: The CARS Act provides consumers with more rights and information, making the car buying process less confusing and risky.

- For dealers: The law requires significant changes to sales and record-keeping practices, which may lead to increased compliance costs and complexity for dealerships.

Compliance Tip:

ASN will implement all necessary updates and modifications to ensure California auto dealers remain compliant with the new rule taking effect on October 1, 2026. Stay tuned for more details as the effective date approaches.

Source: Gov.CA